What kinds of risks does nature loss present to financial institutions?

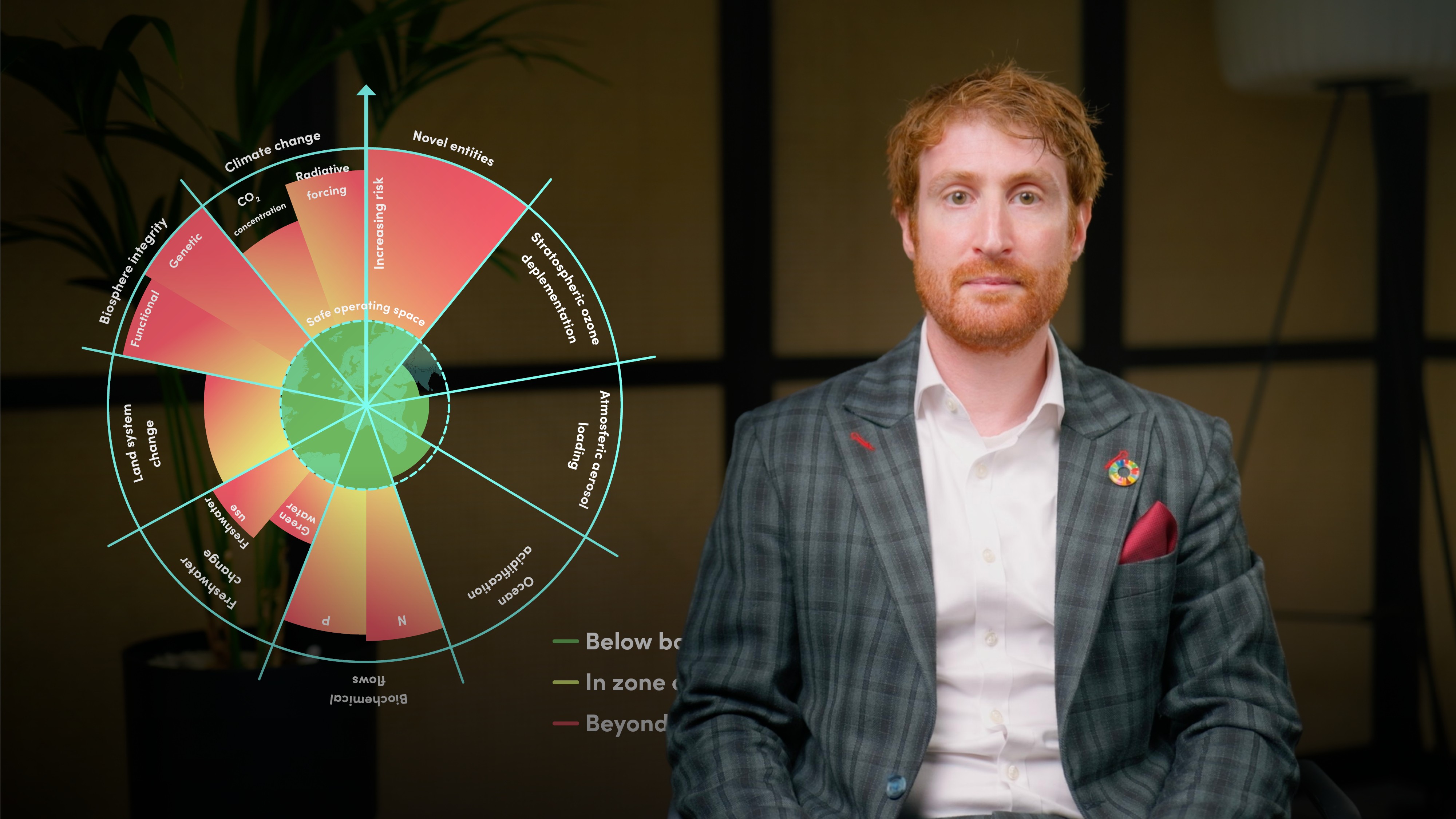

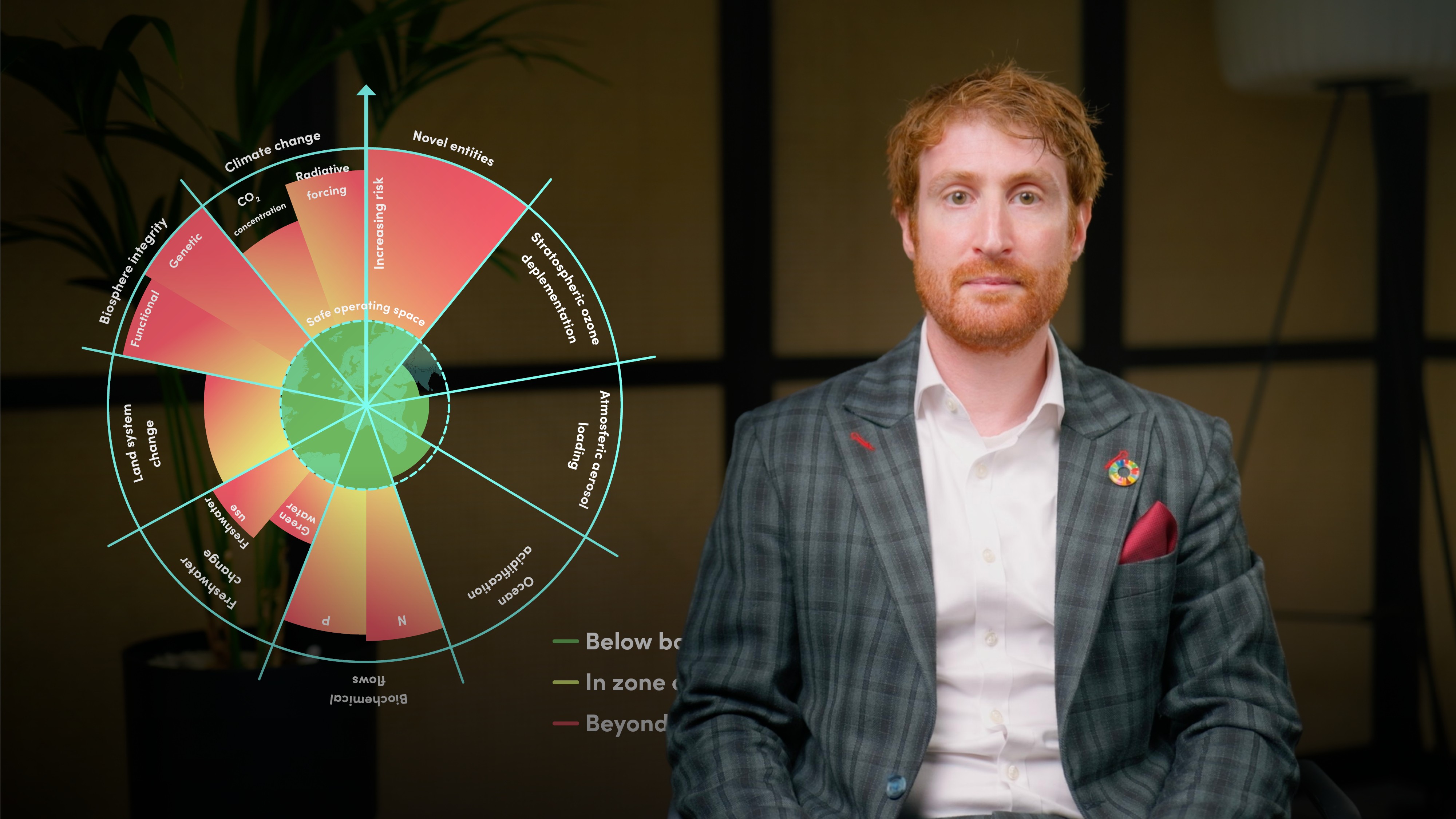

Nature loss creates material financial risks across three categories: physical, transition, and systemic. Physical risks arise from degradation like deforestation or water scarcity; transition risks relate to policy, market or legal shifts; and systemic risks involve ecosystem collapse impacting financial systems. Together, these can lead to volatility, asset devaluation, and instability, particularly for institutions with exposure to nature-dependent sectors like agriculture, real estate, or extractives.

Why are climate change and nature loss interconnected, and why must financial institutions address them together?

Climate change and nature loss are tightly linked. Climate change drives biodiversity loss through rising temperatures, shifting weather patterns, and ecosystem disruption. At the same time, nature degradation, like deforestation or wetland loss, reduces the planet’s capacity to absorb carbon, accelerating climate change. These feedback loops can push systems toward irreversible tipping points. For financial institutions, addressing only one side of this equation can lead to major blind spots. A focus on climate alone may backfire, such as investing in a low-carbon hydro project that destroys critical habitats. Integrating both climate and nature into risk and opportunity assessments enables more accurate valuations, resilient portfolios, and informed strategy. It also aligns institutions with evolving disclosure frameworks like TNFD and increasing stakeholder expectations for joined-up environmental action.

What are nature-related opportunities and how can institutions act on them?

Nature-related opportunities span sectors and strategies. They include restoring ecosystems (like mangroves or coral reefs), investing in regenerative agriculture, or developing sustainable infrastructure. Financial institutions can issue green bonds, launch nature-themed funds, or support nature-based solutions through loans. Tech and innovation also play a role—vertical farming and agroforestry are gaining traction. These investments help preserve biodiversity while unlocking value and resilience. Business models that reduce nature dependencies can enhance brand value, mitigate risk, and meet rising stakeholder expectations. Acting early allows institutions to lead in an emerging market and align with global biodiversity and climate goals.

What frameworks or tools help financial institutions manage nature-related risks and opportunities?

The Taskforce on Nature-related Financial Disclosures (TNFD) provides a structured framework with 14 recommended disclosures across governance, strategy, risk management, and metrics. It aligns with the TCFD while recognising nature’s unique challenges. UNEP FI’s Risk Centre supports implementation through content sessions, tools, and scenario analysis. Together, these resources empower institutions to integrate nature into decision-making, build resilience, and unlock nature-positive investment opportunities.